tennessee auto sales tax calculator rutherford county

Sales Tax Calculator 2022 Davidson County Clerk. 3 rows Sales Tax Rates.

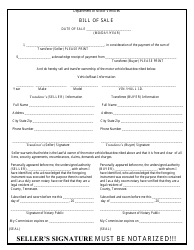

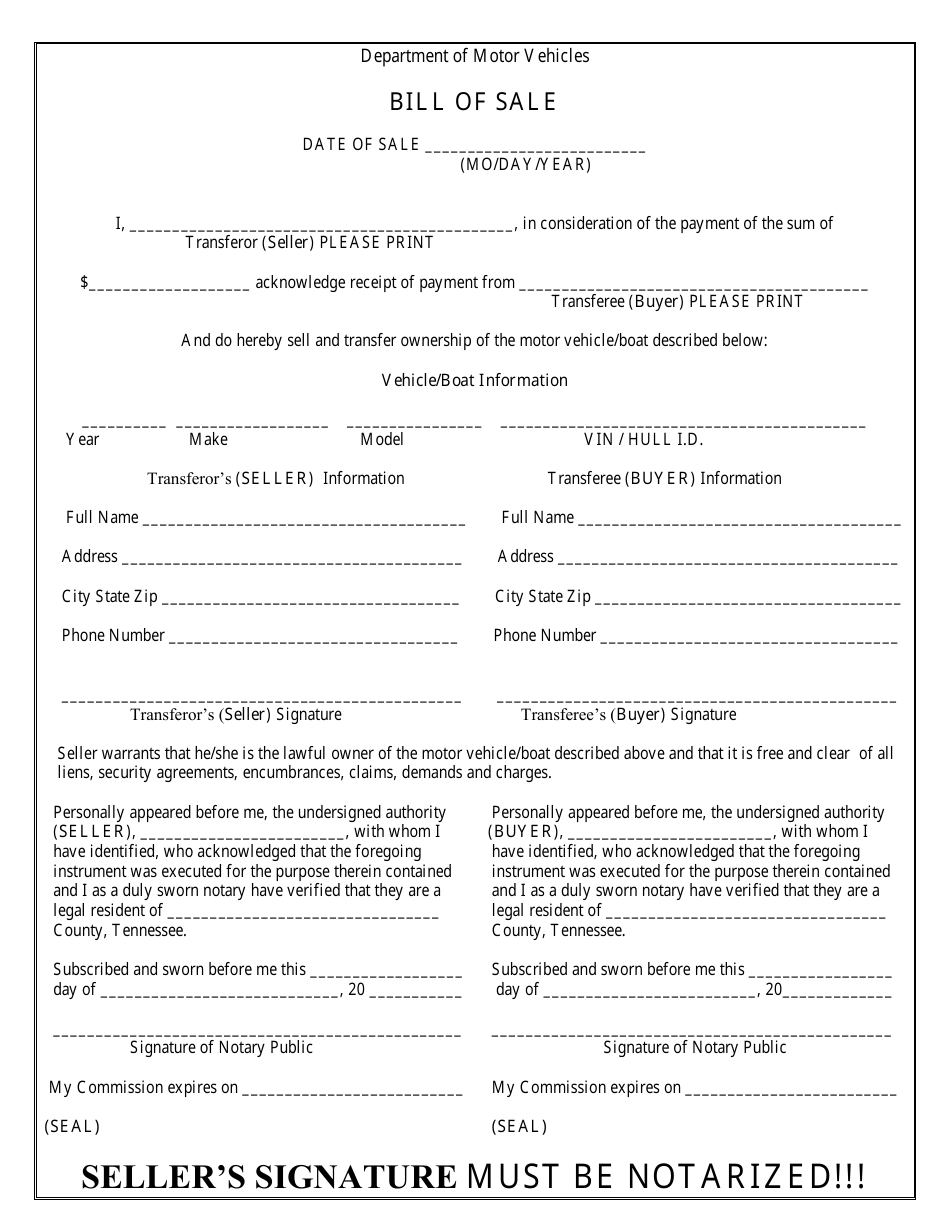

Rutherford County Tennessee Vehicle Boat Bill Of Sale Download Printable Pdf Templateroller

Rutherford County TN Sales Tax Rate.

. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. This is the total of state and county sales tax rates. Tennessee Auto Loan Calculator is a car payment calculator with trade in taxes extra payment and down payment to calculate your monthly car payments.

In addition to taxes car purchases in Tennessee may be subject to other fees like registration title and plate fees. Local Sales Tax is 225 of the first 1600. Motor vehicle or boat is subject to the sales or use tax.

Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. For purchases in excess of 1600 an additional state tax of 275 is added up to. Staff Locations Senior Tax Freeze Tax Relief FAQs Payment Information Tax and Bill Receipts City of Murfreesboro Property Tax Info Search and Pay Taxes Online County Trustee 615-898-7705 Lavergne 615-793-3388 Smyrna 615-898-7705 Murfreesboro.

A county-wide sales tax rate of 275 is applicable to localities in Rutherford County in addition to the 7 Tennessee sales tax. The Tennessee state sales tax rate is currently. State Sales Tax is 7 of purchase price less total value of trade in.

The first 1600 multiplied by the sales tax of the. Title fees should be excluded from the sales or use tax base when. The December 2020 total local sales tax rate was also 9750.

The median property tax on a 15710000 house is 106828 in Tennessee. Cities throughout the state have the option of imposing local taxes which can range from 15-275 depending upon the city and county you live in. The minimum combined 2022 sales tax rate for Rutherford County Tennessee is.

The Rutherford County Sales Tax is 275. The current total local sales tax rate in Rutherford County TN is 9750. Murfreesboro 319 N Maple St.

The median property tax on a 15710000 house is 164955 in the United States. Vehicle Sales Tax Calculator. Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through charges excludable from the sales price of the motor vehicle or boat.

The total sales tax you pay for a car in Tennessee is a combination of state and local taxes calculated by adding together. This amount is never to exceed 3600. In addition to the state tax local taxes can be assessed as well.

Rutherford County collects a 275 local sales tax the. The base state sales tax rate in Tennessee is 7. A single article tax is another state tax to consider when purchasing a car.

You can find more tax rates and allowances for Rutherford County and Tennessee in. The Rutherford County Sales Tax is collected by the merchant on all qualifying sales made within Rutherford County. Tennessee car payment calculator with amortization to give a monthly breakdown of the.

Suite 121 Murfreesboro TN 37130 Phone. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Rutherford County. Tennessee collects a 7 state sales tax rate.

There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. All sales are subject to the standard Tennessee sales tax rate of 7 percent on the dollar. None of the cities or local governments within Rutherford County collect additional local sales taxes.

The Rutherford County sales tax rate is. Total purchase price multiplied by the 7 percent state sales tax rate. Rutherford County Tennessee Sales Tax Rate 2022 Up to 975.

Total vehicle sales price 25300 25300 x 7 state general rate 1771 1600 x 225 local sales tax 36 1600 x 275 Single Article tax rate 44 Total tax due on the vehicle 1851 Clerk negotiates check for 1771 TN sales tax paid by dealer if County Clerk has received the payment from dealer. The one stop shop for the citizens of Davidson County Tennessee to renew their drivers license get a business license get a marriage license and much more. The maximum charge for county or city sales tax in Tennessee is 36 on the first 1600 of a cars purchase price.

Blountville TN 37617. Find your Tennessee combined state and local tax rate. County Clerk Lisa Duke Crowell Elected Official.

The Rutherford County Tennessee sales tax is 975 consisting of 700 Tennessee state sales tax and 275 Rutherford County local sales taxesThe local sales tax consists of a 275 county sales tax. Rutherford County in Tennessee has a tax rate of 975 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Rutherford County totaling 275. 7 State Tax Rate.

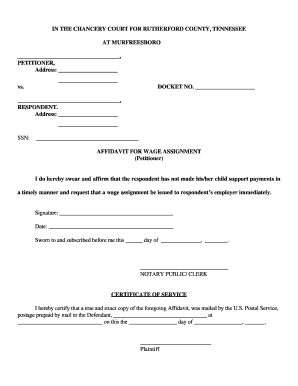

Fillable Online Handbook For Guardianship Conservatorship Rutherford County Tn Fax Email Print Pdffiller

Rutherford County Tennessee Vehicle Boat Bill Of Sale Download Printable Pdf Templateroller

The Hotel Tax Part 1 Rutherford Source

Rutherford County Tennessee Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Clerk Homepage Rutherford County Tn

Rutherford County Sheriff Tn Police Patches Fire Badge Emergency Management

Emissions Testing Eliminated In Rutherford County Replaced By Increased Registration Fee